93% of Business Owners Overpay Their Taxes. Are You One of Them?

When was the last time your tax professional called and said, "I have an idea that will save you money?"

93% of Business Owners Overpay Their Taxes. Are You One of Them?

When was the last time your tax professional called and said, "I have an idea that will save you money?"

Why Do So Many Business Owners Overpay Their Taxes?

A survey published in Forbes magazine showed 93% of business owners pay more tax than they’re legally required to pay. How can that be when most of them have perfectly competent accountants working on their behalf? The answer is that, while most tax professionals do a perfectly good job putting the “right” numbers in the “right” boxes on the “right forms,” that’s when they call it a day. They don’t have the time, the training, or the temperament to help you go beyond mere numbers in boxes.

They tell you how much you owe. But they don’t tell you how to pay less.

Want more proof? Ask yourself, when was the last time your tax pro came to you with an idea to save money? If the answer is “never,” then you’re in that 93% that are paying too much! That's why we offer:

No cost, no obligation discovery call

Plans created by a nationally recognized team of experts

Results guaranteed - it's like heads you win, tails you don't lose

Lowering Your Taxes Works Just Like Going to the Doctor

Most business owners have never done any sort of formal tax planning, so they have no idea how it works. Our process works the same way as what happens when you visit the doctor because you’re sick. Typically, three things happen:

First, the doctor examines you and diagnoses the problem. Does your stomach hurt? Maybe it’s food poisoning. Maybe it’s something more serious. Maybe it’s really bad. Regardless, the doctor has to figure out what the problem is before they can solve it.

Next, the doctor prescribes the solution. What’s it going to take to fix the problem they diagnosed in Step One?

Finally, someone has to fill that prescription. That might involve a trip to the pharmacy for medication. It might mean surgery. It might mean physical therapy. But if the problem is serious, it’s not just going to fix itself.

A Proven Methodology to Help You Pay Less...

Legally. Morally. Ethically.

There’s no cost for us to walk you through our Discovery Call and submit your returns to our team of experts. If you qualify for our service, we’ll tell you upfront exactly how much we’ll save. In fact, we’ll guarantee it, or you’ll get part or all of your money back. It’s like flipping a coin where the rules are “heads you win, tails you don’t lose.” There’s literally no risk to get the ball rolling.

First, we diagnose the "patient"

The “diagnosis” starts with a Discovery Call. We’ll ask you questions about your goals and resources to better understand your situation. Then we’ll review your business and personal tax returns and any supporting documents like investment portfolio statements. That’s how we spot the mistakes and missed opportunities that cost you taxes you don't have to pay.

Next, we write the "prescription"

The prescription takes the form of a written Tax Reduction Plan that introduces you to the strategies you’re missing. Our specialists will use the information gathered in the first step to identify every possible deduction and strategy to achieve the maximum possible savings. And the results are GUARANTEED.

Finally, we "fill" the prescription

We work with our affiliated CPA firm and a team of nationally recognized experts to fill your prescription. From Employee Retention Credits, to Research and Development Credits, to capital gains tax deferral and advanced strategies leveraging trusts and charitable foundations - we work with the best of the best to ensure we meet our guaranteed savings promise.

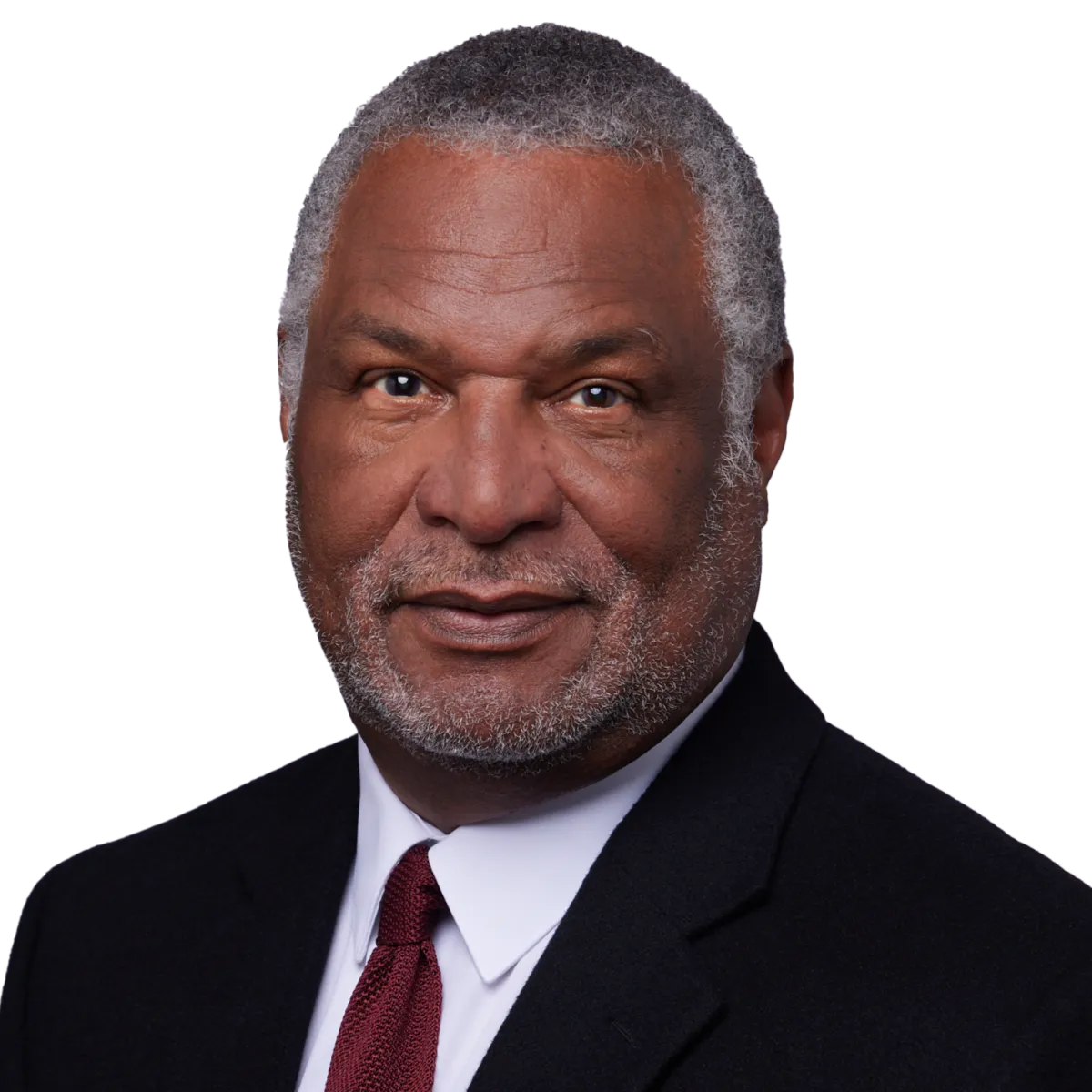

Grady Elliott and the team at Excel Empire help businesses save money through the use of advanced tax strategies

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Phasellus lacus

25+

Years of Experience

1,500+

Happy Clients

$1b+

Tax Credits Claimed

$25m+

Savings Realized

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Phasellus lacus ligula, iaculis non lacinia non, eleifend eu ante. Suspendisse varius finibus nunc sollicitudin egestas.

4.8

5, 432 Customer Reviews

A+

987 Positive Reviews

George Owens

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Quisque nisi nunc, tincidunt non nibh non, ullamcorper facilisis lectus. Sed accumsan metus viverra turpis faucibus, id elementum tellus suscipit. Duis ac dolor nec odio

Max Tanner

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Quisque nisi nunc, tincidunt non nibh non, ullamcorper facilisis lectus. Sed accumsan metus viverra turpis faucibus, id elementum tellus suscipit. Duis ac dolor nec odio

Kim Wexler

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Quisque nisi nunc, tincidunt non nibh non, ullamcorper facilisis lectus. Sed accumsan metus viverra turpis faucibus, id elementum tellus suscipit. Duis ac dolor nec odio

Billy Jackson

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Quisque nisi nunc, tincidunt non nibh non, ullamcorper facilisis lectus. Sed accumsan metus viverra turpis faucibus, id elementum tellus suscipit. Duis ac dolor nec odio

Grady Elliott

Certified Tax & Business Advisor

Many of today’s business owners and groups find that some CPA and tax services don’t fully grasp their unique business frustrations, leaving them worried and dissatisfied. Generally, CPA’s produce tax returns that are IRS compliant – cautious and backward-looking.

They lack forward-looking advanced taxation strategies that can save money on taxes. And remember, according to Forbes, an astounding 93% of business owners are unhappy with their CPA.

Excel Empire is a national organization with virtually based home office in West Palm Beach. We recognize taxes are one of your most significant expenses. Our mission: to revolutionize mid-sized business tax and capital gains tax planning.

Our abundance mindset covers working with successful business owners like you and your families to do three critical things with your wealth and business: (1) KEEP MORE, (2) SAVE MORE, and (3) LEAVE MORE LEGACY.

That’s where I come in. I truly take the time to understand your concerns beyond mere compliance. Excel Empire offers tailored solutions to mid-sized businesses, addressing the complex challenges that keep you up at night. We teach and implement optimized advanced tax and organizational strategies that positively impact your bottom line.

Like high-altitude satellites, we’re constantly reviewing and analyzing the IRS Tax Code, IRS Court Precedence, and IRS Letter Rulings to see if we can improve your situation every year into the future.

If you’re ready to address your unique business frustrations, achieve financial stability, and gain the peace of mind you deserve, don’t hesitate to contact me today. Feel free to DM ME on LinkedIn.

Copyright© 2023 Excel Empire. All Rights Reserved. See disclaimers here.

tel: +1 (888) 444-7109